The celebrity contractor claims his company did not have access to the homes during construction.

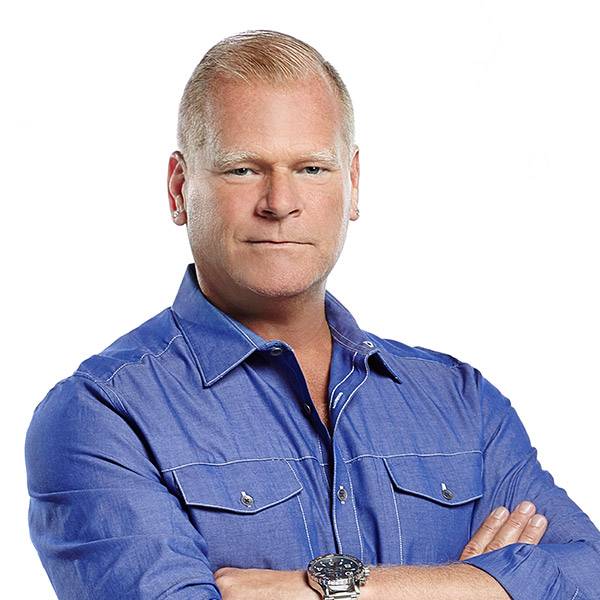

For the first time, Mike Holmes has spoken publicly about a lawsuit that alleges the homes in the Holmes Approved Homes complex in Meaford, Ontario, were built with defects.

The celebrity contractor and popular TV host posted the statement on his Facebook page four days after CBC News reported an update on the lawsuit . The lawsuit was filed in 2021 by Tarion, a consumer advocacy organization for new homes in Ontario.

Holmes said he was “deeply disappointed” by “news reports” about the lawsuit and that “only some” of the statements his company, Holmes Group, provided to the media “were used, and even those were taken out of context.”

Holmes stated that his company did not have access to the homes in the complex during construction, so it was unable to “assist in inspecting or identifying potential problems.”